Widely known as Adelaide’s Debtor Finance Specialist Broker

We have extensive experience in sourcing Debtor Finance facilities across a wide range of Industries across Adelaide and South Australia.

10 Compelling Reasons to Use Debtor Finance:

- No real estate is required.A key requirement of commercial overdrafts is putting up personal or commercial real estate as security. With debtor finance, the value of the invoices secures the finance, so real estate assets are not at risk.

- Get quick access to funds.Debtor finance can often be approved and in place in a matter of days (not months), and once an account is set up, funds can typically be accessed within 24 hours at call.

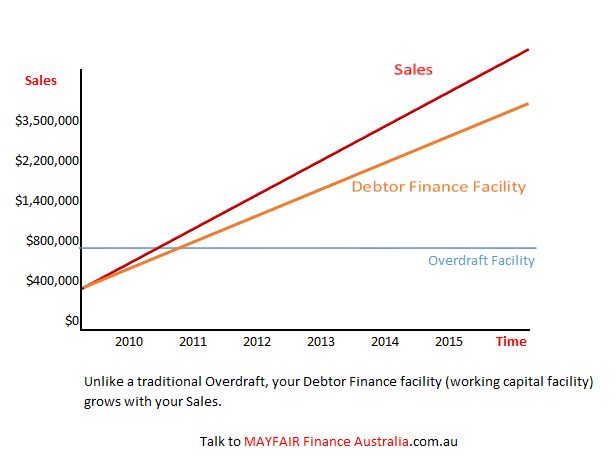

- Flexible limits which can grow as the business grows.When sales and receivables increase over time, your business can quickly receive an increase in funds that are needed to finance this growth.

- Higher funding limits.A common problem is where the funding requirement of the business outgrows the fixed limit of the overdraft. Debtor finance limits are not restricted by the value of property security. Additionally, because receivables are often a large asset on the balance sheet, higher funding limits can be unlocked.

- Less rigidity.No interest cover or debt-servicing cover ratios to comply with. This can assist loss-making or low-equity businesses, meaning it is a powerful solution for young start-up businesses, or service businesses without a large capital base.

- Frees up security for other uses.As debtor finance does not require real estate security, property can then be used as security for other purposes, for example investment and wealth creation.

- Based on your current position, not your history.Debtor finance is based on the value of outstanding invoices (your receivables). This makes it suitable for new growing businesses that have increasing sales and good prospects but have short trading history which often means they don’t qualify for bank funding.

- Bottom line benefits.

Debtor finance facilities provide an accounts receivable service. In some cases, outsourcing this work can be more cost effective than hiring a full time resource.

Additionally, the availability of cash to the business owner via debtor finance can also mean the business can access supplier discounts for volume or early payment, helping to maintain and boost margins.

At the same time, the business’s own early settlement discounts can be reduced or even completely scrapped. - Gain a competitive advantage.In competitive industries, success can come down to better liquidity and speed. A debtor finance facility, used appropriately, provides a business the ability to retain customers on attractive terms as well as ensure reliable cash flow to the business. Additionally, fast access to funds means that while your competitors are waiting months for payments to come in before committing to sales, your business could be saying ‘yes’ to new business earlier.

- Confidence in decision making.The importance of confidence cannot be understated. Businesses need to be making decisions to stay competitive and adjust to their environment and with reliable cash flow assured, an owner can be confident funding will be available to smooth out fluctuations in cash flow and ensure supplier and customer relationships are as strong as possible.

Also known as invoice financing, invoice discounting, receivables finance, cashflow finance, supply chain finance or factoring.

Whatever the term you have heard, they all work on the same principal, using your Debtor Book as Security, to unlock the cash in your business.

For most businesses, their outstanding Invoices (Debtors) are one of their greatest assets which is often frustratingly inaccessible, which can cause ATO arrears, Superannuation arrears and other Supplier (Creditor) issues.

How It Works

•Debtor Finance is an innovative method of providing working capital funding to businesses by using the value of their outstanding invoices as security.

•Debtor Finance provides your business with cash sooner. You are advanced up to 85% of your outstanding invoices you raise on a daily / weekly basis, with the cash becoming available within 24/48 hours.

•Each Debtor Finance Lender has their own guidelines and limitations regarding what Industries and Transactions they fund.

•At Mayfair Finance Australia we invest the time to understand your business and the working capital mismatch in your own specific business. We then discuss the opportunity with several of the most suitable Debtor Finance Lenders to ensure we match the funding, structure and pricing to your specific needs. We then present you with the best 3 proposals and discuss the pro’s & con’s of each.

Some of the primary Industries suitable for Debtor Financing are:

•Transport & Logistics

•Freight Forwarders

•Recruitment / Labour Hire

•Manufacturing

•Wholesalers

•Distributors

•Importers

•Exporters

•Business Services

•Professional Services

Basically if you’ve got a Debtor Book this facility could work exceptionally well for you.

Ability to support Existing or even Start Up businesses.

Some of the facility options available include:

•Confidential facilities

•Disclosed facilities

•Combined Trade Finance & Debtor Finance facilities

•Single Invoice Factoring

•Contract/ Progress Draw Debtors

•Higher Debtor Concentrations >33%

•Fixed Price & Variable Price facilities

•Some Lenders have the capability to assess your customers ability to pay, potentially reducing the risk of bad debts

•Debtor Insurance to minimise your bad debt risk

Why Debtor Finance? This facility is ideally suited in the following circumstances:

•Rapid sales growth squeezing working capital

•To support businesses looking to expand

•Labour intensive businesses where wages have to be met well ahead of payment receipts

•Leverage your Debtors to enhance your cash flow position.

•As your business grows, the Debtor Finance facility grows with it

•Businesses looking to standalone

•Debtor Finance, unlike Overdrafts, does not require real estate security (in 95% of cases)

•Businesses outgrowing their available equity in Property or Plant & Equipment

•Removal of personal property from business security

•Release or reduce the reliance on property securing the business and enable you to leverage this property to build wealth outside of the business

•Replacing or reducing debt secured by the family home

•Management / Partner buy-out

•Unlock your business assets to fund acquisitions / mergers

•Ownership changes and succession

•A stand alone facility that can sit alongside other business borrowings (such as long term loans, leasing)

•Fast access to your Debtor’s outstanding Invoices – no more waiting 30, 60 or 90 days.

•Debtor Finance is a self-liquidating facility, meaning that your company isn’t technically taking on any additional debt. In theory if you decided to close your business tomorrow, your Debtor Finance facility should be repaid in full as your Debtors pay their Invoices.

•Fast access to the cash tied up in your Debtor’s (outstanding Invoices) – no more waiting 30, 60 or 90 days.